CAPC Finance Calculator

Our financial calculators may come in handy when you are trying to calculate how much your debt is going to really cost you. These calculators are to help you get the best understanding of your financial situation in addition to assisting you in making informed financial decisions in the future. Understanding your debt is the first step towards a debt-free lifestyle.

If you have any questions or concerns, please feel free to reach out to our debt counselors, who are here to help.

Try our FREE handy

CREDIT CARD CALCULATOR

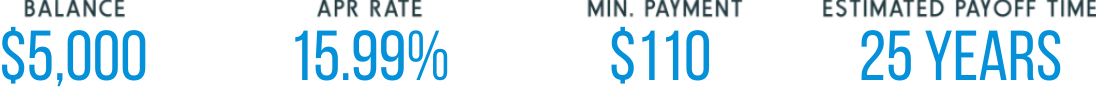

Credit card debt can be tricky and can spiral out of control if you do not know how credit card debt works. If you are paying just the minimum payment due on your credit cards each month is going to cost you more money in the long run. The minimum payment owed each month is largely just the interest fee, and consequently very little of the payment is applied to your actual debt. Check out our credit card interest calculator to determine what your debt is costing you.

| Total Time: | 0 |

| Total Payments: | $0.00 |

| Total Interest: | $0.00 |

How Do Credit Cards Work?

This video describes how credit cards work and how your payments are calculated with interest rates factored in. Having recurring credit card debt will cost you more in long run. Understanding how your debt works are the first steps to taking control of your debt. Use our free credit card calculator above and discover how much you are really paying for your credit cards.

Struggling with your debt? We can help!

Talk to a debt counselor today and take control of your debt. Call for a free financial assessment with a certified credit counselor and receive a customized budget and a no-obligation debt relief quote.

For more information visit our FAQs